Public Library District Toolkit: Strategies to Assure your Library’s Legal and Financial Stability

- Preface

- Introduction

- Good, Better, Best: An Introduction to Library Governance & Funding in New York State

- Getting on the Ballot

- Public Library Districts

- Getting Started

- Establishing the District

- Conclusion

- Appendices

- Libraries by Type

- Laws Governing Public Libraries in New York State

- Association Libraries and Trustee Elections

- Sample Legislation: Special and Consolidated District Public Libraries

- Election Responsibilities

- Home Rule Message for Special or Consolidated Library Districts

- Tax Exempt Status

- Public Library Investments

- NYS Property Tax Cap Answers to Frequently Asked Questions

- Lessons Learned: Advice from Libraries who have re-chartered

- Public Library District Questions and Answers

- Municipal Ballot Votes for Library Funding in New York State

- Public Library Service to the Smithtown Community: A Fact Sheet on Special Library District

- Frequently Asked Questions about Reed Memorial Public Library District (2013)

- Vestal Public Library School District Vote 2016

- Bloomfield Public Library Vote Frequently Asked Questions 2018

- Sample Petition Chapter 414

- Sample Special District Trustee Petition

- Helpful and Related Information

NYS Property Tax Cap Answers to Frequently Asked Questions

In June 2011 the Real Property Tax Levy Limit bill was signed into law in New York State. While there is no specific mention of libraries in the bill, the Governor's office, Division of Budget (DOB) and the Office of the State Comptroller (OSC) have made it clear that the intent is for the law to apply to public libraries as well. So what does this mean for your library?

Which libraries does it apply to?

Libraries that have had a public vote on their budget - special district public libraries, school district public libraries and those municipal public libraries and association libraries that have used the 414 municipal ballot or 259 school district ballot options fall directly under the new regulation.

Does the cap apply to our whole budget or our levy amount?

The law applies to the amount of taxes levied on behalf of your library at the local level. The law states that the tax levy may not be raised more than "2%," or the Consumer Price Index (CPI) whichever is lower, unless 60% of your board approves a request to the taxpayers above this level and a simple majority of voters approves the request at the level you propose.

If our budget vote is a 414 (municipal ballot) or 259 (school district ballot) do we have our own cap or are we under the cap of the municipality / school district?

Guidance provided to OSC from the NYS Division of Budget clearly states that libraries with their own boards of trustees that can use the 414 or 259 process have their own cap. This is cited on the OSC web site in their Frequently Asked Questions![]() document.

document.

How do we calculate the “2%”?

The actual dollar amount of the "2%" tax levy limit for your library is calculated using a formula. Each year your library is now required to file an online form, with OSC, prior to the adoption of your budget. The information you submit in this form will be combined with a variety of data elements (see below) to calculate the dollar amount of your tax levy limit or “2%.” This number is likely to be different from just doing a raw 2% calculation with a calculator based on the amount you have previously asked taxpayers for.

When is the online form available?

For libraries with a calendar fiscal year (January 1 – December 31): Early September

For Libraries with a school fiscal year (July – June): Mid-January

When is the online form due?

For libraries with a calendar fiscal year (January 1 – December 31): prior to the adoption of the budget

For Libraries with a school fiscal year (July – June): March 1st

Can the library ask for more than a 2% increase if necessary?

Your board can put forth an amount to the voters that is over the calculated 2% figure by using an override procedure. The override procedure involves passing a resolution by 60% of eligible voting members of your board prior to the approval of your budget by your board. If the resolution at the board level passes you may put up a levy request that goes above the tax levy limit you have calculated through the Comptroller's online form.* Once this has been done you will follow the same procedures for enacting a public vote on your budget as usual, the public vote still would need to pass by a simple majority. [Sample override resolution language![]() is available from the New York Library Association.]

is available from the New York Library Association.]

Can our board do an override resolution that would cover all future library budget votes?

No, your board may not do a "blanket override" that would apply to future years.

Our budget cycle does not align with the release of the data necessary to fill out the OSC online form to calculate the 2% amount, what should we do?

Until regulation is developed to address this situation it was suggested at workshops held around the state in 2011, by staff from OSC, that it is allowable, possibly advisable, to pass an override resolution regardless of the amount you ultimately ask the public for each year to "protect" your library. They made this suggestion in light of the fact that should your library, accidentally or knowingly, be approved for funds beyond your tax levy limit (for example, if your calculations are off) without the override resolution in place, your library is liable for the difference in the amount, plus interest, should you be audited. Currently, OCS is verbally encouraging libraries to adjust their vote date or fiscal year so that they can file the form prior to the adoption of the budget.

Our library does not have a public vote on our budget; do we need to fill out the online form?

Libraries that have never had a public vote on any portion of their budget do not need to fill out the online form from the Comptroller. Your situation remains the same as it always has in that you will need to negotiate with your municipality for funds for your library. The amount your library receives will be a part of your municipality's tax cap calculation - you do not have a separate cap calculation from them.

For more information:

- Office of the New York State Comptroller

:

:

- OSC Property Tax Hotline: 518-473-0006

- User Guide for the Real Property Tax Calculation Form

- The Property Tax Cap Guidelines for Implementation

from the New York State Department of Taxation and Finance and the New York State Department of State

from the New York State Department of Taxation and Finance and the New York State Department of State

Prior fiscal year tax levy: provided by the library

Tax base growth factor![]() : provided by the Department of Taxation & Finance

: provided by the Department of Taxation & Finance

PILOTs Receivable: A PILOT is a payment in lieu of taxes. These are payments made to compensate a local government for some or all of the tax revenue that it loses because of the nature of the ownership or use of a particular piece of real property. Usually it relates to the foregone property tax revenue negotiated to entice a business into your area. Special District, School District public libraries and Municipal libraries may be due funds through PILOT. Check with your local Industrial Development Agency (IDA).

Allowable levy growth factor: Lesser of 1.02 or inflation factor (percent change in CPI for the 12 month period ending 6 months before the start of the coming fiscal year over the prior 12-month period), but never lower than 1.00. Provided by the Office of the State Comptroller![]() .

.

Available Carryover: You are permitted to carryover up to 1.5 percent of the prior year levy limit if you were under your tax levy limit. In accordance with guidelines issued by the Department of Taxation and Finance, there is no carryover permitted for unused exclusions associated with growth in pension costs or tort judgments.

Transfer of Government Function: Unlikely to apply, refers to if “government functions are transferred between governments.” However, if you think this may apply to you an OSC regional office would calculate the figure for you.

Exclusions

- Court Orders / Judgments arising from tort action in excess of 5% of the total taxes levied in the prior fiscal year

Increases to the system average actuarial contribution rate: For libraries with employees in the NYS Retirement System only: Pension costs resulting from growth in any pension system’s average actuarial or normal contribution rate that exceed two percentage points may be excluded from the property tax levy limit. OSC provides an Excel tool![]() that will help you in calculating the amount of pension costs that may be excluded.

that will help you in calculating the amount of pension costs that may be excluded.

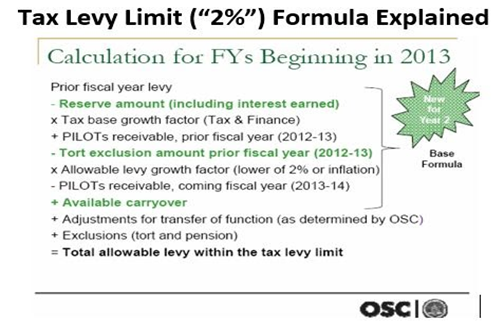

Text description of Tax Levy Limit Graphic:

Tax Levy Limit ("2%") Formula Explained

Caluculation for FYs Beginning in 2013

Prior fiscal levy

- Reserve amount (inlcuding interest earned)

x Tax base growth factor (Tax & Finance)

+ PILOTs receivable, prior fiscal year (2012-13)

- Tort exclusion amount prior fiscal year (2012-13)

x Allowable levy growth factor (lower of 2% or inflation)

- PILOTS receivable, coming fiscal year (2013-14)

+ Available carryover

+ Adjustments for transfer of function (as determind by OSC)

+ Exclusions (tort and pension)

= Total allowable levy within the tax levy limit

Note: The first eight lines of the formula comprise the base formula (new for Year 2)

- Last Updated: Jul 11, 2024 10:03 AM

- URL: https://nyslibrary.libguides.com/pldtoolkit

- Print Page